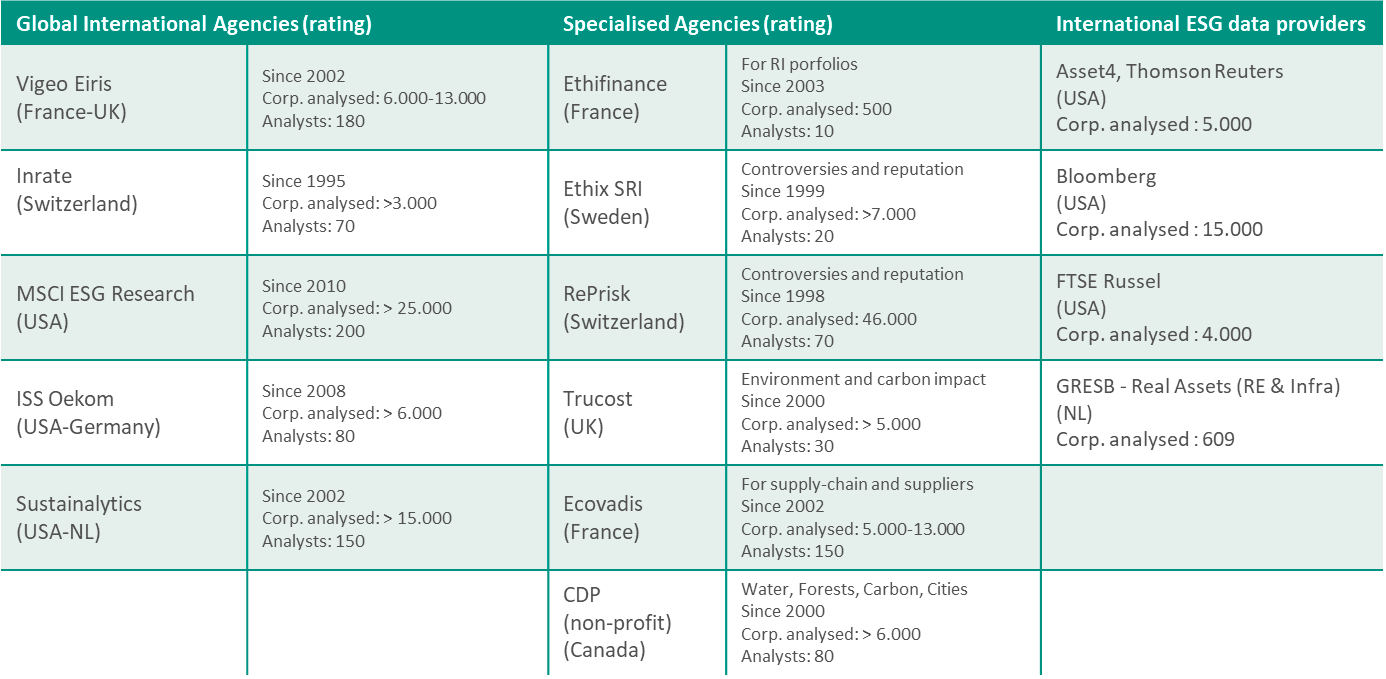

The number of Environmental, Social and Governance (ESG) indices has skyrocketed in recent years amidst increased demand from investors. These indices have benefited from an abundance of research and data lately, and have become benchmarks to help define sustainable and ESG investing for passive investment funds (ETF, quant, index).

Each index has its own publicly documented methodology and is created in collaboration with a non-financial rating agency or an independent ESG data provider.

Euronext closely works with:

- Vigeo Eiris

- Carbone 4

- CDP

- ISS

- GRESB (Real Estate)

- Etc.

Main rating agencies and ESG data providers

Source: Internal Euronext Corporate Services research

Rating agencies and ESG data providers collect questionnaires and filter through the ESG criteria that issuers disclose to their stakeholders through their website or various public documents (annual report, non-financial reporting such as the NFRD, GRI Index, voluntary ratings, etc.). All of this data is used to design the indices. It is therefore essential for issuers to have a proactive disclosure policy but also to maintain control of the criteria they want to highlight and measure.

|

Supporting your ESG transition Our experienced ESG Advisory team can help to advise issuers on these topics and present their sustainable strategic ambitions to the financing community, through extensive data collection and analytics. Get in touch to start structuring your own ESG strategy to ensure long-term financing. |

Issuer inclusion in ESG indices

Inclusion in sustainable indices is of mounting significance to IR teams and it is no surprise that IR teams wish to be included wherever possible to boost investor interest and liquidity.

For issuers who do not appear in the major indices, it can be challenging to work on a trajectory that guarantees their inclusion because of several criteria considered in the methodology, first of all free float, volumes and market cap. Nevertheless, it is possible to isolate many exclusion factors against which to work (with a sincere and concrete CSR strategy for example):

- The lowest ESG scores for each of the 3 pillars are almost systematically excluded in 100% of the methodologies.

- The “Climate Change Impact” criterion predominates and is becoming increasingly stringent. The Euronext ESG indices and those of our competitors are aligning themselves with the trajectory defined by the Paris Agreements (containing the rise in the planet's temperature well below 2°C compared to pre-industrial levels). It is important to note that it is based on actual measurements and no longer statements of intent.

- Controversies criteria are gaining more and more weight. As such, the ratings developed by players such as Reprisk, Covalence and Sustainalytics stand out as benchmarks.

- More conventionally, the application of the sector exclusion as defined by the PRI appears as the basis of the responsible investment approach (90% of global managers have signed it and are supposed to apply it). Some asset managers go even further by extending the exclusion from sectors such as Oil & Gas, Mining, and Alcohol.

To be included in an ESG index can be highly challenging for some issuers. Euronext Corporate Services’ ESG Advisory team offers an alternative perspective through the understanding of ESG investment strategies in shareholding.

Beyond indices – ESG at the core of the company values

In the meantime, investor demand and the rise of ESG passive investments call for more varied thematic indices, improving the exposure of issuers. One could reasonably expect that those who do not want to get involved in a concrete and sustainable trajectory will have a difficult time remaining relevant in the eyes of investors. They could quickly suffer a withdrawal from their shareholders, or even activist campaigns that will not necessarily be capital-intensive. For example, US and UK funds are practicing "Name & Shame" with ESG matters, although major long-term investors chose the path of engagement with their holdings to report the pressure on ESG matters.

Consequently, the more sustainability is part of the corporate strategy and is integrated into financial communication (investor relations, integrated reporting, non-financial reporting, ESG disclosure policy, appropriate standards, updated website, etc.), the more the issuer is visible and referenced by investors, both passive and active. If its financial performance follows, the rest fits together logically.

The strong demand for sustainable assets and the wave represented by passive investment is leading index producers to innovate and diversify their offering. The multiplicity of ESG criteria makes the exercise of non-financial analysis and comparison difficult – this is why more and more asset managers are launching index funds that replicate an ideal portfolio made up of sustainable stocks.

Issuers are conscious of how difficult it is to engage with passive funds. The appetite for ESG indices from these passive investors represents a real opportunity for issuers to diversify their financial communications and spread their sustainable achievements and objectives.

In conclusion we would say that it can be challenging for an issuer to set itself the objective of being included in a specific ESG index. Nevertheless, issuers must continue to enhance their sustainable profile in general – not just to have a chance to be included in an ESG index, but because investors increasingly expect sustainability to be embedded into a company’s DNA.

Related articles

-

New Governance solutions with AGM Voting Insight and ESG Data distribution

Read the article -

CSRD Reporting Requirements: A Comprehensive Guide

Read the article -

How to Tell a Powerful Equity Story (Step-by-Step)

Read the article

Share this post